What Are the Essential Incorporations in Insurance Coverage You Should Know?

Whether it's health, car, or home owners insurance, comprehending crucial inclusions such as deductibles, protection restrictions, and exclusions can protect against unanticipated economic problems. abilene tx insurance agency. In wellness insurance coverage, the incorporation of mental wellness solutions and coverage for pre-existing problems can substantially affect long-lasting health.

Recognizing Secret Insurance Coverage Components in Health And Wellness Insurance Policy

When examining health insurance policy policies, it is crucial to comprehend the key coverage elements that can substantially influence both cost and top quality of treatment. These elements consist of deductibles, copayments, and out-of-pocket maximums, which figure out how much the insured will pay prior to the insurance policy contributes and caps yearly investing.

Prescription medicine protection is another vital aspect, as medications can be a major cost element in medical care. Furthermore, psychological health and wellness services and rehab insurance coverage are progressively identified as essential components of thorough medical insurance. Each of these components should be very carefully contrasted across various plans to make sure that the chosen policy adequately fulfills the individual's wellness demands.

Crucial Features of Car Insurance Policy Policies

Just as with health insurance, selecting the ideal vehicle insurance coverage plan calls for an understanding of its important functions. Primarily, obligation insurance coverage is required in the majority of territories, covering problems to others created by the policyholder.

Accident Protection (PIP) is crucial, covering medical expenditures for the policyholder and travelers no matter mistake. In addition, uninsured/underinsured driver insurance coverage is critical, protecting versus costs incurred from accidents with drivers who do not have sufficient protection.

Each insurance policy holder should likewise take into consideration the policy limitations and deductibles, as these impact out-of-pocket expenses before insurance contributions. Variables like the vehicle's make, usage, and design can affect premiums, making it vital for consumers to assess their particular requirements against potential threats and expenses.

Important Parts of Homeowners Insurance Coverage

Understanding the critical parts of homeowners insurance policy is necessary for efficiently securing one's home and monetary health. This sort of insurance policy usually encompasses a number of crucial elements. The dwelling protection is extremely important, as it addresses the price to fix or rebuild your house itself in instance of damages from covered risks such as fire or tornados. An additional element, personal building insurance coverage, shields the components of the home, consisting of furniture and electronics, against loss or damages (abilene tx insurance agency).

Each element is indispensable to guaranteeing detailed protection. Property owners need to carefully evaluate their plan limits and take into consideration possible local risks, readjusting their coverage appropriately to safeguard versus considerable financial influence.

Final Thought

In conclusion, when selecting insurance policy policies, it is crucial to comprehend essential components such as deductibles, copayments, and details coverages. Auto insurance needs crucial responsibility insurance coverage, while house owners insurance policy ought to comprehensively cover both residence and personal property.

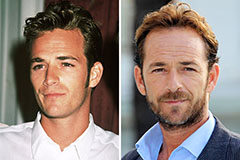

Luke Perry Then & Now!

Luke Perry Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now!